We created this guide, including the FAQs below, to help you choose the right health insurance plan in Michigan for you and your family. An ACA Marketplace plan may be a good choice for many consumers, including those who do not have access to Medicare, Medicaid, or an employer’s health plan.

Michigan’s ACA Marketplace plans – also known as Obamacare plans – are available on the federally-run HealthCare.gov platform, although Michigan lawmakers are considering legislation in 2024 that would direct the state to create a state-run exchange platform that would be in use by the fall of 2025. 1

The Michigan Marketplace provides access to health insurance products from nine private insurers, 2 although plan availability varies by area. 3 For 2025, the number of participating insurers is expected to grow to ten, with the entry of HAP CareSource. 4

Depending on your income and circumstances, you may qualify for financial assistance that can offset the cost of the coverage you obtain through the Michigan Health Insurance Marketplace.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Michigan.

Learn about Michigan's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Michigan as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Michigan.

You can purchase individual/family coverage in the Michigan Marketplace (exchange) if you meet these criteria: 5

Although most people are thus eligible to enroll in a Marketplace plan, there are additional criteria to qualify for financial assistance in the Marketplace. To be eligible for subsidies: 6

Subsidy eligibility is also based on how your income compares with the premium for the second-lowest-cost Silver plan in the Marketplace (for premium subsidies) and whether your income is more or less than 250% of the federal poverty level (for cost-sharing reductions).

In Michigan, the open enrollment period for individual and family insurance runs from November 1 to January 15.

Enrollments completed by December 15 will take effect on January 1, while enrollments completed between December 16 and January 15 will take effect on February 1.

Outside of open enrollment, you can enroll in new coverage or make changes to your existing coverage during a special enrollment period if you’ve experienced a qualifying life event. Learn more about qualifying events.

Michigan residents use HealthCare.gov to enroll in individual and family health plans. You can also sign up with a licensed agent/broker or a Navigator. There is also an option to enroll through various third-party websites authorized by the Centers for Medicare & Medicaid Services. 8

In Michigan, consumers may find affordable health insurance by enrolling through the ACA Marketplace (HealthCare.gov).

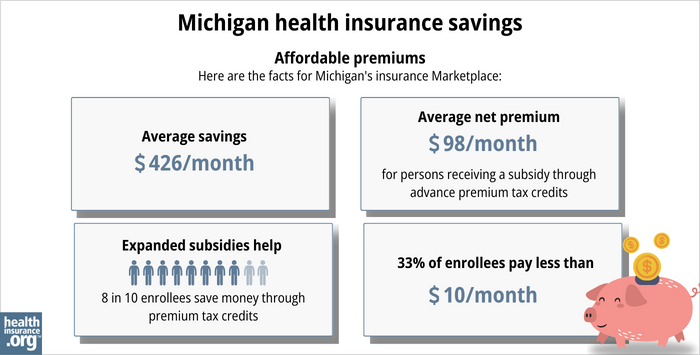

Nearly nine out of ten enrollees are eligible for advance premium tax credits (APTC), which reduce the amount that they have to pay each month for their coverage. In 2024, the average premium subsidy in the Michigan Marketplace amounted to $426/month. 9 Subsidy-eligible enrollees in Michigan paid an average net premium of $98/month after subsidies in 2024. 10

People with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that may reduce your deductibles and out-of-pocket expenses when you buy a Silver plan. 11

Both the premium tax credits and the CSR benefits are only available in Michigan if you enroll in a Marketplace plan.

s insurance Marketplace: Average savings - $426/month. Average net premium - $98/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 33% of enrollees pay less than $10/month." width="700" height="355" />

s insurance Marketplace: Average savings - $426/month. Average net premium - $98/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 33% of enrollees pay less than $10/month." width="700" height="355" />

Depending on your household income, you may be eligible for Medicaid/CHIP. Michigan is among the states where Medicaid has been expanded under the ACA, making it easier for low-income adults to qualify for coverage. Learn more about Michigan Medicaid.

For 2024 coverage, nine insurers offer exchange plans in Michigan. 2

A tenth insurer, HAP CareSource, plans to offer coverage in the Michigan exchange for 2025, 13 and has filed rates and plans via SERFF. 14

There were ten Marketplace insurers in Michigan in 2023, but one of them, U.S. Health & Life/Ascension Personalized Care, opted to withdraw from the market at the end of 2024. According to U.S. Health & Life’s discontinuation notice, there were more than 5,000 enrollees in five Michigan counties whose coverage terminated at the end of 2023. 15 These individuals were able to select replacement 2024 coverage from another insurer during open enrollment.

For 2025, ten insurers have submitted rates and plans for Michigan Marketplace/exchange coverage. The proposed rates, which amount to a proposed overall increase of 10.5% before any subsidies are applied, are under review by the Michigan Department of Insurance and Financial Services. 16

The insurers have proposed the following average rate changes for 2025:

Source: Michigan SERFF and ACA Signups. 17

Rates for 2025 will be finalized before open enrollment begins in November 2024. Your premium change might be quite different from the average that applies to your insurer, as it also depends on where you live (rates vary by region for each carrier), your age, and your income.

The average premium changes described above are for full-price (unsubsidized) premiums. However, most Marketplace enrollees qualify for subsidies, so they do not pay full price. 18 For these enrollees, net premium changes depend on changes in their own plan’s price as well as changes in their subsidy amount from one year to the next.

For perspective, here’s an overview of how average premiums have changed in Michigan’s individual/family market over the years:

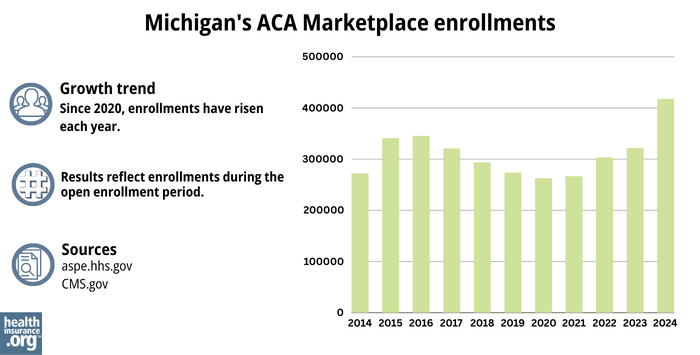

418,100 people enrolled in private health plans through the Michigan Exchange/Marketplace during the open enrollment period for 2024 coverage. 18

This was a substantial record high (see below for prior year enrollment totals). The increases in recent years have been driven in large part by the subsidy enhancements created by the American Rescue Plan and Inflation Reduction Act.

And the 2024 growth is also due in part to the fact that Medicaid disenrollments resumed in 2023, after being paused for three years during the pandemic. As of February 2024, CMS reported that 138,106 Michigan residents who had previously been covered by Medicaid had transitioned to Marketplace coverage. 28

Source: 2014, 29 2015, 30 2016, 31 2017, 32 2018, 33 2019, 34 2020, 35 2021, 36 2022, 37 2023, 10 2024 38

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.