by India CSR

Reading Time: 11 mins read

ICICI Bank, a leading private sector bank in India, has published its Environmental, Social and Governance (ESG) Report for 2020-21. ‘Building a Sustainable India’, the report chronicles the Bank’s environmental, social and governance initiatives as a responsible corporate citizen.

The Bank has highlighted in the report its multifarious initiatives towards mitigating environmental impact, increasing usage of renewable energy, promoting inclusive growth for the under-privileged, following responsible lending practices and abiding by the high standard of corporate governance. Keeping with the idea of an interconnected world with synergies across various facets of the shared ecosystem, the Bank’s efforts are aimed at building a sustainable tomorrow in line with its ‘Environment, Social and Governance Framework’.

As a large financial conglomerate, ICICI Bank understands that by integrating the idea of preserving the environment into its business paradigm, its work can have a positive impact. This is particularly important as the Bank conducts business across the country. The usage of renewable energy has been implemented across all its premises wherever feasible, with an aim to reduce its carbon footprint.

In fiscal 2021, the Bank sourced close to 5% of its total electricity consumption from renewable sources. Among the Bank’s many novel endeavours, it has added 97.5 KWp (kilowatt peak) of solar power capacity in fiscal 2021, taking onsite renewable energy capacity to 2.9 MWp (megawatt peak). The Bank saved 9 million of A4 size sheets of paper through its digital banking initiatives, equivalent to saving 1,100 trees and 4.5 million litres of water.

Over the years, ICICI Bank has customised its products and services as well as brought in state-of-the-art digital interventions to cater to the financial requirements of its rural and semi-urban customers. The Bank also serves rural value chains by identifying large ecosystems and leveraging opportunities within these ecosystems. ICICI Bank, under its inclusive banking initiatives, has empowered 600,000 Self Help Group (SHGs) transforming 8 million rural women into entrepreneurs of which 3.6 million women were first time borrowers. The Bank has introduced more than 21 million individuals into the formal banking system by opening basic savings accounts — the highest by any private sector bank in India.

As part of the skill training programme, ICICI Foundation for Inclusive Growth – the CSR arm of ICICI Group – has trained more than 59,000 youth and assisted them in finding suitable jobs during fiscal 2021. The training was imparted to underprivileged youth through three vehicles of ICICI Foundation namely, ICICI Academy for Skills, ICICI Foundation’s Rural Livelihood Programme and ICICI Rural Self Employment Training Institutes (RSETIs). The Bank has also supported the government, local authorities and frontline workers with financial aid and protective equipment to overcome the unprecedented challenges of the Covid-19 pandemic.

The corporate governance framework at ICICI Bank is based on an effective independent Board, the separation of the Board’s supervisory role from the executive management the constitution of several Board Committees to oversee and provide a strategic direction for critical areas. These include risk and performance, business practices and ethics, legal and regulatory guidelines, disclosure and transparency code, monitoring framework and communication protocol.In the wake of the Covid-19 pandemic, the Bank accelerated its efforts to mitigate the impact of the pandemic on all its stakeholders including customers, employees and communities. Its initiatives have largely been centred around three broad areas – providing immediate relief to communities, ensuring the safety and well-being of all its employees and enabling customers to avail uninterrupted banking services.

Some of the Bank’s environmental, social and governance initiatives highlighted in the Report are given below:

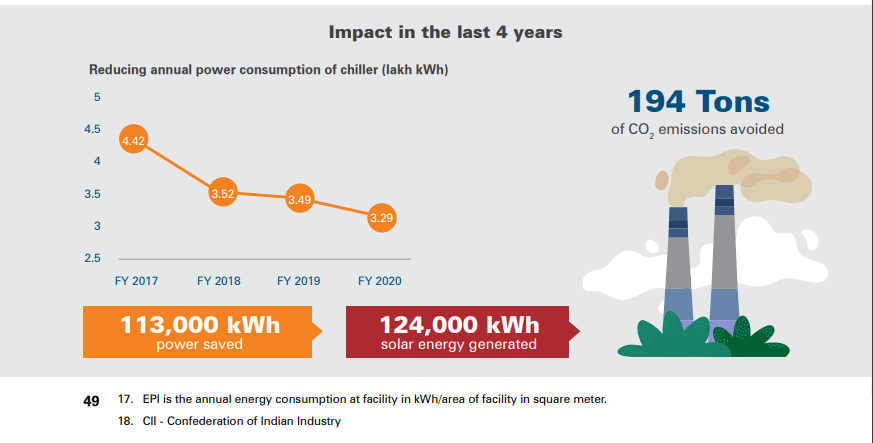

ICICI Bank is committed to energy efficiency and is always seeking to adopt environment friendly practices in its operations. In this endeavour, the Bank has incorporated several changes to its operations across its branches and offices. These include optimising energy consumption, reducing wastage of resources, and making sure to recycle and reuse.

The Bank’s energy conservation strategy focuses on three areas — improvement of existing energy efficiencies, investment in superior design and technology, and adoption of renewable energy. Large offices of the Bank are designed in such a way that these conserve energy, manage water and waste in the eco-friendly manner. The ESG Report highlights that as on March 31, 2021, 11 offices spread across 2.28 million sq. ft. have been certified with a ‘Platinum’ rating by the Indian Green Building Council (IGBC), the country’s premier body for green building certification.

During the year, the Bank added 97.5 KWp of new solar power capacity at eight of its premises across the country. The total onsite renewable energy capacity at these premises is 2.9 MWp. Total power generation from these systems was 3 million kWh (kilowatt hour) during fiscal 2021, an increase of nearly 70% over the previous fiscal.

The Bank has implemented energy savings efforts in 1,100 branches having high energy consumption. This has helped in saving 6.52 million kWh energy at these branches. Additionally, it has replaced old air-conditioning systems with a capacity of over 4,500 Tonnes of Refrigeration (TR) with new inverter-based, 5-Star rated systems at branches and ATMs, reducing 25% of energy consumption.

A rooftop solar plant of 21 KWp capacity installed at ICICI Bank’s branch at Udaipur University, Rajasthan

ICICI Bank ensures that water consumption at its large offices is lower than the benchmark. The Bank recycles and reuses waste water at three large offices. All new offices and branches opened during the financial year were fitted with water efficient plumbing fixtures.

ICICI Bank has been a pioneer in digitisation and adoption of emerging technologies in banking. A large focus of these measures has been geared towards saving paper. During the fiscal, the Bank also enabled digitisation of high volume service requests on its mobile and internet banking platforms. This has led to 98% of nomination updates, 60% of requests for change of address and 28% of ReKYC (Know Your Customer) and profile updates undertaken digitally.

With consistent communication and awareness programmes, a large number of customers have adopted communication via e-statements, SMS and e-mails. The Bank is an industry leader in the digital sourcing of products. Over 90% of the savings account transactions in fiscal 2021 were done through digital channels, which included internet, mobile, point of sale (POS), touch banking, phone banking and debit card e-commerce transactions. Also, 90% of the personal loans, 75% credit cards, 64% Systematic Investment Plan (SIPs) and 56% Fixed Deposit (FDs) were sourced digitally.

The Bank’s conscious and continuing efforts during the period led to savings of over 9 million sheets of A4 size paper, equivalent to saving nearly 1,100 trees and 4.5 million litres of water.

The Bank is focused on imparting financial education and creating awareness of banking services in the unbanked and underbanked areas of the country. Under the Self-Help Group-Bank Linkage Programme (SBLP), the Bank encourages the idea of entrepreneurship among underprivileged rural women and helps them earn sustainable livelihoods. ICICI Bank’s ESG Report highlights that it has cumulatively provided loans to over 8 million women beneficiaries through more than 600,000 Self Help Group (SHGs). Through these SHGs, it has empowered millions of women to recognize their dream of financial independence. Of these, 3.6 million women were first time borrowers.

On the financial inclusion front, ICICI Bank delivers banking solutions through an extensive network of over 5,260 branches; half of them are in rural and semi-urban areas. Nearly 650 of the rural branches are in villages that were previously unbanked. In addition, the Bank has over 3,315 ATMs servicing customers in semi-urban and rural areas. The expansive network of branches and ATMs is further supplemented by over 4,000 customer service points (CSPs) as of March 31, 2021. The outreach is supported by a network of business correspondents who service customers at nearly 12,800 unbanked locations. Further, it has 100,000 digital points that enable Aadhaar authenticated transactions such as cash withdrawal, deposit and fund transfer, among others.

As a large and responsible financial institution, ICICI Bank undertakes several initiatives in the areas of skill development and sustainable livelihoods, financial literacy and financial inclusion, healthcare and other social projects across rural and urban areas through ICICI Foundation. ICICI Foundation implements various sustainable livelihood initiatives through ICICI Academy for Skills, ICICI Foundation Rural Livelihood Programme and ICICI Rural Self Employment Training Institutes (RESETIs). In the wake of the Covid-19 outbreak, ICICI Foundation developed new digital models of delivering skill development programmes online, enabling livelihood opportunities for migrants and supporting the farmer community by helping them manage their produce and link to markets.

The ESG Report has highlighted that ICICI Foundation has trained close to 581,000 people through its diverse skill development initiatives till March 31, 2021 since inception. It has offered 100% job placement assistance to trainees who opted for it.

ICICI Foundation operates 28 skill training centres in 21 states and union territories through the ICICI Academy for Skills. These academies provided pro bono towards industry-relevant, job-oriented training in 10 technical and three non-technical skills. They are equipped with state-of-the-art practical labs to support and enhance learning as part of a comprehensive approach that ensures employment opportunities for all successful trainees. Modules on financial literacy, life skills, and soft skills are also included in skill training. Due to the ongoing pandemic, new models of training delivery were implemented across the skill academies, combining digital learning with hands-on experience in labs. In fiscal 2021, ICICI Academy for Skills trained more than 14,200 youth and assisted them in finding suitable jobs. The efforts of the skill academies collectively impacted the lives of nearly 160,000 people, of which 43% were women.

ICICI Foundation’s Rural Livelihood Programme continued to identify clusters of villages with gaps for driving interventions. The goal of the Rural Livelihood Programme is to establish supply chains and synergies that will increase the value of the intervention and make it more sustainable. These value chain interventions are aimed at improving yield quality, local product quality, market linkages, and taking an inclusive approach by providing low-investment entrepreneurial opportunities to landless and other excluded communities.

Despite the challenges of Covid-19, ICICI Foundation’s efforts benefited over 31,800 people in 365 villages during fiscal 2021. Since its inception, efforts in rural areas have impacted the lives of more than 307,000 people in 2,500 villages, of which 61% were women.

ICICI Foundation manages two RSETIs in Udaipur and Jodhpur, and 18 satellite centres throughout Rajasthan. These centres offer skill-training programmes based on the needs of the local market, thus improving employment opportunities for the beneficiaries. Providing online training in mobile phone repair and service was a one-of-a-kind initiative this year which helped young beneficiaries earn a livelihood when the country was under a complete lockdown. Through online training, ICICI RSETIs covered over 450 candidates across 271 villages in Udaipur and Jodhpur. The skill trainers conducted online theory sessions on a digital platform which was followed up with apprenticeship at over 160 mobile shops. Since inception till March 31, 2021, RSETIs provided pro bono vocational training to 114,000 beneficiaries in over 60 trades. Nearly 58% of them are women. During fiscal 2021, around 13,300 beneficiaries were trained.

ICICI Bank follows responsible financing practices by laying emphasis on environmental and social risk management. The Bank’s ‘Social and Environmental Management Framework’ integrates the analysis of the environmental impact of a proposed project and the assessment of its social risks, into the overall credit appraisal process. The Bank has financed projects for capacity creation in renewable energy sectors like solar, wind and hydro power and other sustainable sectors like waste processing and mass rapid transport.

The ESG Report mentions that the Bank has a dedicated internal group to identify and grant financial assistance to projects that promote biodiversity, environmental sustainability and initiatives in education, health, sanitation and livelihoods. The group disburses and manages funding lines received by the Bank from various bilateral and multilateral agencies and the Government of India. The Bank identifies the relevant projects and extends financial assistance either directly or through a collaboration.

ICICI Bank and ICICI Foundation have undertaken a series of comprehensive efforts to mitigate the impact of the pandemic on all the stakeholders including customers, employees and communities. The initiatives have been centred around three broad areas – providing immediate relief to communities, ensuring the safety and well-being of all the employees and enabling customers to avail uninterrupted banking services.

Below are the category wise initiatives undertaken by ICICI Bank and ICICI Foundation:

The ICICI Group donated Rs. 1 billion to support the nation in the early days of the pandemic. The ICICI Group directly contributed Rs. 800 million to the ‘PM Cares Fund’. ICICI Bank’s contribution amounted to Rs. 500 million out of the total amount. The bank also reached out to state governments, district administrations, municipal corporations, police forces and hospitals by providing support and critical material such as masks and sanitizers in all states and union territories covering more than 550 districts.

ICICI Bank also deployed mobile ATM vans across various cities to bring key banking services to the doorstep of residents who were advised to stay home. It has also contributed mobile vans and kiosks for Covid-19 testing and ambulances to district administrations.

Employee safety and well-being were prioritised, and the Bank took care to provide a safe and healthy work environment. The Bank launched a focussed programme to vaccinate all its employees and their immediate family members. The Bank assisted its Covid-affected employees and their families by enabling medical e-consultation and assisting with quarantine and hospitalisation facilities.

The Bank accelerated its efforts in the area of digital banking and launched a slew of offerings as well as loan products to supplement the existing suite of digital and mobile banking solutions. The objective was to ensure that customers were able to fulfil all their banking requirements from the safety of their homes. Some of the key offerings introduced during the pandemic are – ICICI STACK which offers nearly 500 services that encompass almost all banking requirements of customers; WhatsApp Banking; Chatbot and Voice Banking, Home Utsav, Insta loan against Mutual Funds, Cardless EMI, and Insta Education loan, among others.